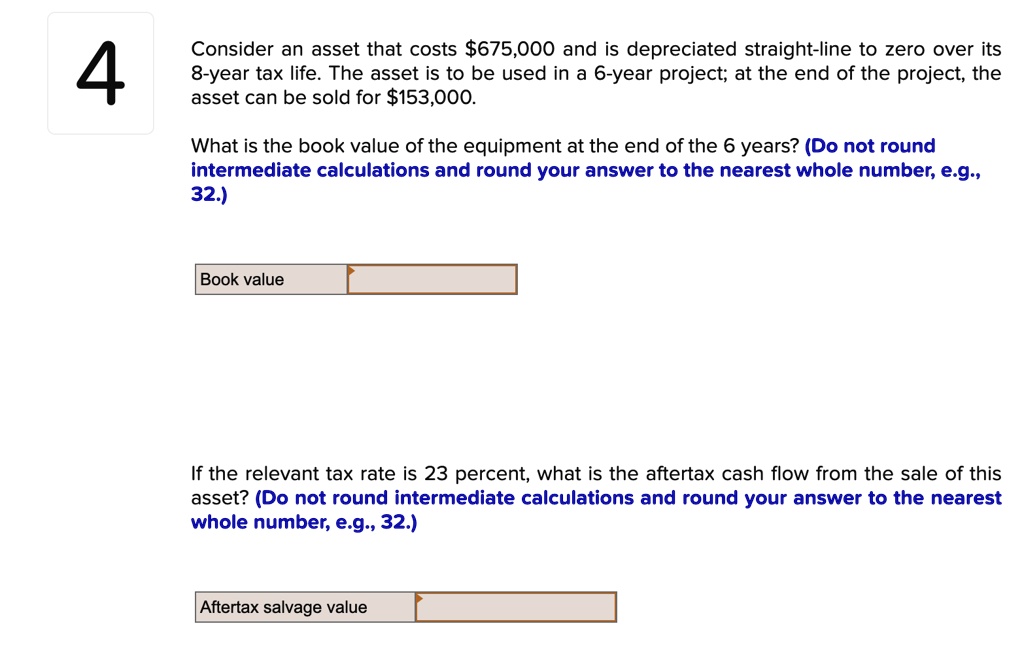

When an asset has reached the end of its useful life, it may still have value in its individual components or as scrap. Companies can sell these parts or scrap to recover some of the asset’s value, thus reducing the overall cost of ownership. This difference in value at the beginning versus the end of an asset’s life is called “salvage value.”

Straight-Line Method

This method estimates depreciation based on the number of units an asset produces. The straight-line depreciation method is one of the simplest ways to calculate how much an asset’s value decreases over time. It spreads the decrease evenly over the asset’s useful life until it reaches its salvage value.

Salvage Value Depreciation Equation

Companies take into consideration the matching principle when making assumptions for asset depreciation and salvage value. The matching principle is an accrual accounting concept that requires a company to recognize expense in the same period as the related revenues are earned. If a company expects that an asset will contribute to revenue for a long period of time, it will have a long, useful life.

Why Calculate After-Tax Salvage Value?

- If the asset is sold for less than its book value then the difference in cost will be recorded as the loss of the tax values.

- The applicable tax rate on the gain from the asset sale significantly impacts the after-tax salvage value.

- Companies use this value to figure out how much to subtract from the original cost of the thing when calculating its wear and tear.

- There’s also something called residual value, which is quite similar but can mean different things.

Salvage value is important in accounting as it displays the value of the asset on the organization’s books once it completely expenses the depreciation. It exhibits the value the company expects from selling the asset at the end of its useful life. The balance sheet shows the net book value of an asset, which is the original cost minus accumulated depreciation, helping stakeholders understand the asset’s current worth. By considering the after-tax salvage value, businesses can make strategic decisions about whether to sell an asset or continue using it.

What happens when there is a change in a depreciable asset’s salvage value?

This $1,000 may also be considered the salvage value, though scrap value is slightly more descriptive of how the company may dispose of the asset. We can see this example to calculate salvage value and record depreciation in accounts. So, total depreciation of $45,000 spread across 15 years of useful life gives annual depreciation of $3,000 per year. In such cases, the free proforma invoice template insurance company decides if they should write off a damaged car considering it a complete loss, or furnishing an amount required for repairing the damaged parts. So, in such a case, the insurance company finally decides to pay for the salvage value of the vehicle rather than fixing it. Technological advances can significantly impact the determination of salvage value.

Business Decisions

The depreciable amount is then determined by subtracting the salvage value from the asset’s cost. Salvage value plays a crucial role in determining the worth of an asset at the end of its useful life. It represents the estimated value of an asset when it is no longer useful or productive to a company. Understanding salvage value is significant as it influences various financial decisions regarding asset management and depreciation. It includes equal depreciation expenses each year throughout the entire useful life until the entire asset is depreciated to its salvage value. At this point, the company has all the information it needs to calculate each year’s depreciation.

This calculation helps in evaluating the net benefit of disposing of an asset versus keeping it in operation. If the asset is sold for less than its book value then the difference in cost will be recorded as the loss of the tax values. In some contexts, residual value refers to the estimated value of the asset at the end of the lease or loan term, which is used to determine the final payment or buyout price. In other contexts, residual value is the value of the asset at the end of its life less costs to dispose of the asset. In many cases, salvage value may only reflect the value of the asset at the end of its life without consideration of selling costs. An estimated salvage value can be determined for any asset that a company will be depreciating on its books over time.

60% depreciation is reported over 6 years and salvage value is 40% of the initial cost of the car. Depreciation is an essential measurement because it is frequently tax-deductible. Salvage value is a critical concept in accounting and financial planning, representing the estimated residual value of an asset at the end of its useful life.

This method involves obtaining an independent report of the asset’s value at the end of its useful life. This may also be done by using industry-specific data to estimate the asset’s value. Scrap value might be when a company breaks something down into its basic parts, like taking apart an old company car to sell the metal. Companies can also use industry data or compare with similar existing assets to estimate salvage value.

However, with the double-declining balance method, the rate is doubled to $4,000 per year. The double-declining balance method is a depreciation technique used to calculate the reduction in value of an asset over its useful life. This method allows for faster depreciation in the earlier years and slower depreciation in the later years. Ignoring taxes on gains from asset sales can lead to overestimating the asset’s value, resulting in incorrect financial reporting. Calculating after-tax salvage value ensures that all tax liabilities are accounted for, providing a true reflection of the asset’s worth. Furthermore, salvage value also aids in strategic decision-making related to the potential sale of depreciated assets for parts.

With a large number of manufacturing businesses relying on their machinery for sustained productivity, it is imperative to keep assessing the equipment they own. Constant use and other factors like the nature and quality of these assets cause a continual deterioration. It is important to set an initial salvage value, which represents the estimated value of the asset at the end of its useful life.