The impact of the salvage (residual) value assumption on the annual depreciation of the asset is as follows. In order words, the salvage value is the remaining value of a fixed asset at the end of its useful life. The salvage value is considered the resale price of an asset at the end of its useful life. This means that of the $250,000 the company paid, the company expects to recover $40,000 at the end of the useful life. Since technology is not going anywhere and does more good than harm, adapting is the best course of action.

How to Calculate After-Tax Real Interest Rate

This value plays a crucial role in financial decision-making as it affects various aspects such as depreciation, asset disposal, and capital budgeting. Understanding the definition and significance of salvage value helps business owners and managers make informed choices and plan for the future. In the following sections, we will explore the exact meaning of salvage value and delve into its relevance in business operations.

What Is the Loss for Tax Value?

- For example, consider a delivery company that frequently turns over its delivery trucks.

- But generally, salvage value is important because it’s the value a company puts on the books for that thing after it’s fully depreciated.

- Both declining balance and DDB require a company to set an initial salvage value to determine the depreciable amount.

- It represents the estimated value of an asset when it is no longer useful or productive to a company.

- You can find the asset’s original price if the salvage price and the depreciation rate are known to you with the salvage calculator.

- The units of production method is appropriate for assets that are mainly used based on its output or production levels, such as machinery.

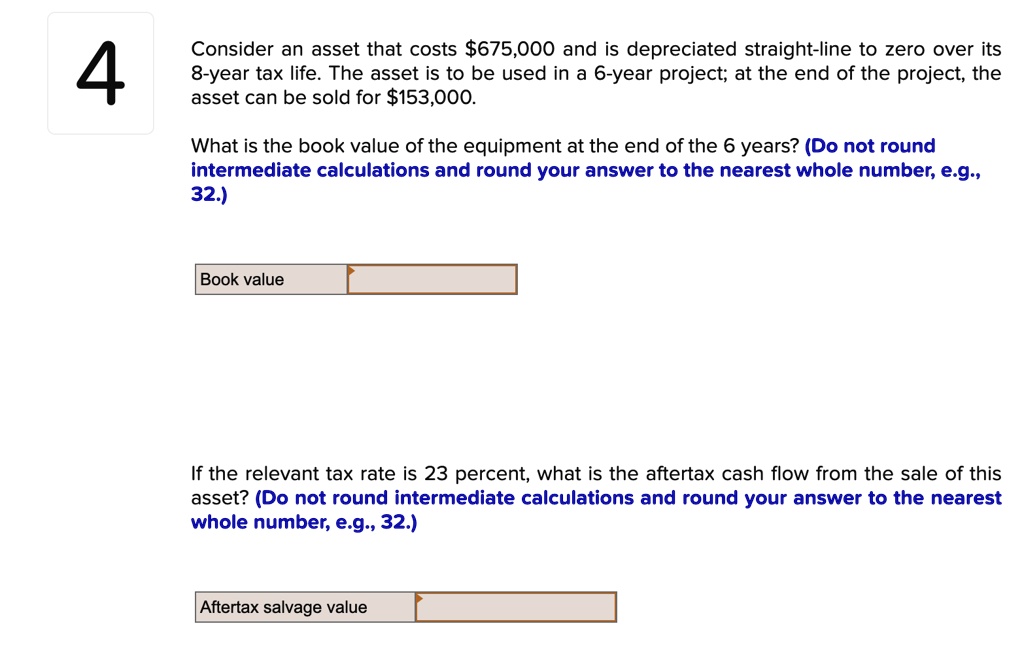

On the other hand, salvage value is an appraised estimate used to factor how much depreciation to calculate. Depreciation represents a reduction in the asset’s value over time due to wear, tear, and obsolescence. Calculate accumulated depreciation up to the disposal date using your preferred method (straight-line, declining balance, etc.), ensuring compliance with relevant accounting standards.

How Is Salvage Value Calculated?

Salvage value is also called scrap value and gives us the annual depreciation expense of a specific asset. It must be noted that the cost of the asset is recorded on the company’s balance sheet whereas the depreciation amount is recorded in the income statement. Depreciation, on the other hand, is the systematic allocation of the cost of an asset over its useful life. It is a method of recognizing the decline in value and the wear and tear of an asset over time. Depreciation expense is reported on the income statement and reduces the value of the asset on the balance sheet.

Depreciation Method

As is clear from the definition, the value of equipment or machinery after its useful life is termed the salvage value. Simply put, when we deduct the depreciation of the machinery from its original cost, we get the salvage value. The estimated useful life of the machine is 5 years, and its salvage value is determined to be $2,000. If the market is saturated with similar assets, the salvage value may be lower due to decreased demand.

It’s also handy for guessing how much money they might make when they get rid of it. Salvage value helps to figure out how much your old stuff is worth when it’s done being useful. It’s the estimated value of how can i get my 401k money without paying taxes something, like a machine or a vehicle, when it’s all worn out and ready to be sold. This differs from book value, which is the value written on a company’s papers, considering how much it’s been used up.

For example, consider a delivery company that frequently turns over its delivery trucks. That company may have the best sense of data based on their prior use of trucks. Companies can also get an appraisal of the asset by reaching out to an independent, third-party appraiser.

Briefly, suppose we’re currently attempting to determine the salvage value of a car, which was purchased four years ago for $100,000.

If there is a decrease in the salvage value, depreciation expense will increase and vice versa. Depending on how the asset’s salvage value is changing, you may want to switch depreciation accounting methods and report it to the IRS. Besides, the companies also need to ensure that the goods generated are economical from the customer’s perspective as well. Overall, the companies have to calculate the efficiency of the machine to maintain relevance in the market.